Inman News

Private indices show that rent peaked in early 2022. But the impact of the rapid increase in rent could still show up in inflation readings for months, economists told Inman

A year ago, economists knew that the meteoric rise of rent would help to drive up inflation.

Worse still, they knew the high cost of homes sold and homes rented could push inflation higher and keep it there for months.

In February 2022, rent was 17.2 percent higher than it was a year before, and economists predicted it would impact inflation for a full 12 months.

February 2022 was the peak of the run-up in rent prices, yet more than a year later, the inflation category that accounts for shelter has continued to climb to a point that’s higher than it has been in decades.

The stubborn inflation of rent has surprised some economists, helped keep overall inflation higher than federal targets, and led to yet another interest rate hike by the Federal Reserve.

“The month-over-month numbers have been much higher for longer than I expected,” said Jay Parsons, chief economist at rental data firm RealPage.

During the last inflation report in February, cost of shelter posted the largest month-over-month change in the past three decades. That’s particularly bad, given the cost of shelter accounts for a third of the weight for inflation, the single biggest factor.

“The shelter component of CPI is driving the top line numbers now more than it was last year,” said Chris Salviati, senior housing economist at Apartment List.

But economists expect that trend could finally start to slow in the coming months, with implications for interest rates, the economy and real estate.

Here’s why rent has such a big impact on inflation, why it’s still having an impact and when experts expect it to finally begin falling.

How does rent factor into CPI?

Americans have been talking about the inflated price of eggs and milk lately, given that they’re some of the most inflated food items in the nation, according to Federal Reserve Economic Data.

But housing is typically the biggest expense people pay every month in the U.S., so its impact on inflation is significantly larger than a carton of eggs.

For renters, the government tracks payments to landlords, plus any utilities that are part of the lease agreement. For owners, it computes what owners would pay to rent a similar home, according to the Brookings Institution.

Homeowners’ utilities, also inflated, are already tracked through other measures of inflation.

To account for the impact of home prices on owners, the federal government does the computation for homeowners’ equivalent of rent rather than the entire home price because most owners will have ongoing costs to pay for the home, rather than one upfront price.

That index found the cost of shelter — including both rent and owners’ equivalent rent — was up 8.12 percent year-over-year in February.

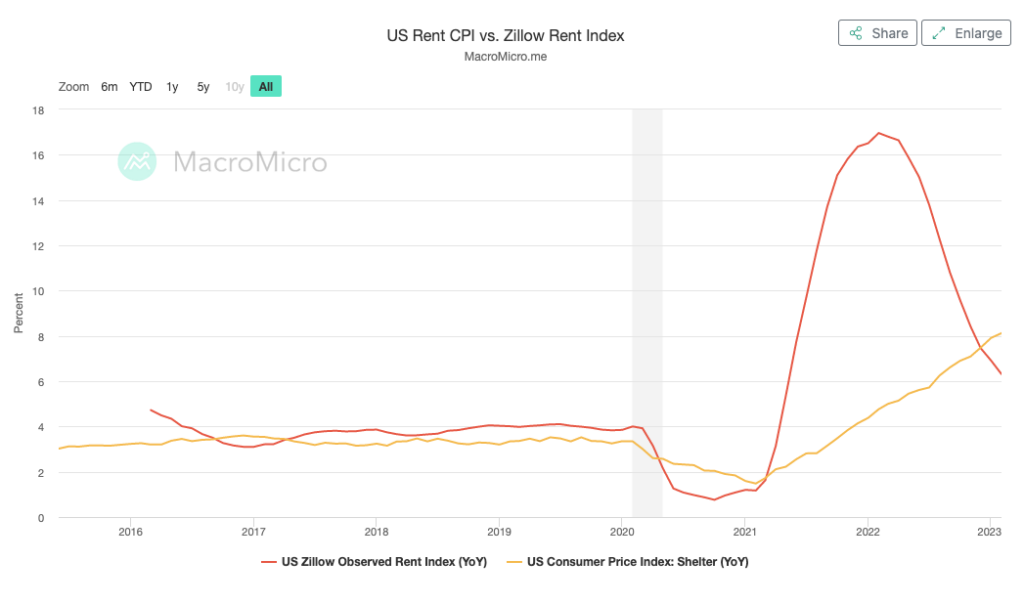

That’s out of sync with what’s shown by private indexes, like the Zillow Observed Rent Index (ZORI) and the CoreLogic Single Family Rent Index. Both show near real-time changes in the price of rent.

CoreLogic reported single-family rent fell for the ninth-consecutive month in January, the latest month for which its data is available. ZORI shows rent growth has slowed every month since February 2022, even going negative month over month in November, December and January.

Those are real-time looks at typically higher-tier detached rental units that advertise in the Multiple Listing Service, according to the Federal Reserve Bank of Cleveland.

The Bureau of Labor Statistics, meanwhile, conducts its own larger survey of a broader swath of rental housing, Salviati said, likely capturing the mom-and-pop landlords who make up about half of the rental housing stock in the U.S.

“The Apartment List data that we have is heavily skewed towards large, professionally managed multi-family properties,” Salviati said. “We don’t get some of that smaller mom-and-pop type inventory. The BLS data is meant to be fully representative.”

The federal government’s data on shelter showed that it began its quick rise above historical norms in 2022, while private indexes were showing rent rapidly rose in 2021 and, in hindsight, was reaching its peak in February 2022.

Housing was joined with inflation across sectors like utilities, food and vehicles in 2022, and the Federal Reserve responded with a series of rapid increases to the federal funds rate.

And while other metrics of inflation have begun to fall back toward federal targets, rent has yet to catch up, and it’s not clear when it might.

Why has rent’s impact lingered for so long?

But that still leaves the question of why the high cost of shelter has kept inflation high for so long.

“Whether you look at our data or Zillow or anyone else, the peak growth for spot rents, new lease rents, asking rents, that was 2021,” Parsons said. “A lot of us really thought that by the end of last year we would have seen a pullback in the month-over-month numbers, which would eventually show up in the year-over-year numbers. That really hasn’t happened.”

The Federal Reserve Bank of San Francisco has found there’s a 12-month lag between private market rent indexes, like the Zillow Observed Rent Index (ZORI) and inflation.

“When asking rents rise, they push up the average rent of the entire stock of rental units as new contracts are signed and enter the database used to compute the rent component of overall inflation,” the San Francisco Fed wrote in an Economic Letter last year in a warning that the high cost of housing could drive up inflation for years.

Rental leases are often for 12-month periods, so renters who signed new leases a year ago were doing so when Zillow data shows rent was up 16.7 percent compared to a year earlier, and 20.3 percent higher than April 2020.

Because rent peaked in February 2022, researchers expected rent’s impact on inflation to begin dropping in February 2023.

In reality, that month saw the highest change in the consumer price index in decades, helping to keep overall inflation above 6 percent.

“Normally that 12-month lag is pretty typical,” Salviati said. “The big swings we’re seeing right now are extraordinary. The magnitude of those swings might make that lag a little bit longer, or potentially a bit more unpredictable.”

The Federal Reserve Bank of Cleveland called it “concerning” that Zillow’s rent index showed a 15 percent year-over-year rise in rent early last year while the federal government’s CPI for rent was 5.5 percent.

Its researchers found the discrepancy was caused by the difference in data used by private firms versus the federal government. When it adjusted for only new leases, the federal rent index was much closer to Zillow and CoreLogic’s indexes.

That means federal housing inflation data might continue to post increases even though private firms are reporting rent is slowing down.

“We won’t see a real slowdown in 2023 as it relates to the year-over-year rent numbers in CPI,” Parsons said. “The month-over-month numbers have to slow down first and they were so big through the second half of 2022 and now early 2023.

“Those numbers carry into the YOY calculation for a full 12 months,” Parsons said. “So it’s going to be a while.”

When does it end?

In response to the highest level of inflation since the early 1980s, the Federal Reserve quickly and repeatedly raised interest rates to levels not seen since October 2007, only recently suggesting it could pause the hikes.

Members of a Fed committee have indicated they think the interest rate has been hiked nearly enough to achieve desired levels of inflation, and that the rates could fall to 3.1 percent — from 4.57 percent — by the end of 2025.

Paired with the fact that builders last year were adding multifamily housing at a faster rate than any time in recent memory and economists expect more downward pressure on rent that should begin showing up in new federal housing surveys.

“Rents should be calming down by the second half of the year because of the massive amount of new apartment construction,” said Lawrence Yun, chief economist for the National Association of Realtors. “These empty units will steadily hit the market and the additional supply will lessen the rent pressure.”

That in turn will cause inflation to stay lower, Yun added, possibly leading to a return to lower mortgage rates.

“The Federal Reserve may even lower its interest rate at that time, depending on economic circumstances,” he said. “Mortgage rates will fall. Home sales will rise and help support the economy.”

There’s reason for hope that change is around the corner, Salviati said, even within the coming months.

The paper by the Federal Reserve Bank of Cleveland found rent growth may have peaked in the second quarter of 2022.

“Assuming a 12-month lag there, I think we can expect it to turn a corner,” Salviati said. “My best guess is probably sometime around the middle of the year.”

If the biggest factor in inflation begins to fall, it would help to bring down the need for the Fed to continue hiking interest rates by mid- to late-2023.

“It could happen even sooner than that,” Salviati added.