CALCULATEDRISK

By Bill McBride

According to the ICE September Mortgage Monitor report:

Press Release: ICE Mortgage Monitor: Property Insurance Costs Are up 4.9% in 2025, 11.3% Over Last 12 Months

Intercontinental Exchange, Inc. … today released its September 2025 ICE Mortgage Monitor Report, highlighting the continued surge in property insurance costs and its growing impact on overall mortgage affordability.

The report found that the average annual property insurance payment for single-family mortgage holders has climbed to nearly $2,370 per year, accounting for 9.6% of average monthly mortgage-related expenses when factoring in principal, interest, taxes and insurance (PITI). This marks the highest share on record and underscores the disproportionate role insurance costs are playing in rising homeownership expenses.

“Property insurance costs continue to be the fasted growing subcomponent of mortgage payments among existing homeowners,” said Andy Walden, Head of Mortgage and Housing Market Research at ICE. “While mortgage principal, interest and property tax payments have all increased in recent years, insurance has far outpaced those gains, rising 4.9% in 2025, 11.3% annually and nearly 70% over the past five and a half years. That rapid escalation now means insurance alone consumes almost one in every ten dollars spent on average mortgage-related costs.”

emphasis added

Mortgage Delinquencies Decreased in July

Here is a graph of the national delinquency rate from ICE. Overall delinquencies decreased in June and are below the pre-pandemic levels. Source: ICE McDash

- The national delinquency rate fell by 8 basis points (bps) in July to 3.27%, a 9-bps improvement year over year (YoY) and 58 bps below pre-pandemic levels

- Inflow of new delinquencies dipped by 13% from June and were down 5% from the same time last year, driving the second consecutive YoY decline in the national delinquency rate, as cures modestly outpaced new delinquency rolls in the month

- Cures rose by 17% in the month, but remained 9% below last year’s levels

- Loans 90+ days past due but not in foreclosure held steady. While serious delinquencies are up 30K YoY, that is the smallest annual increase since November, as the impacts from recent wildfires and last year’s hurricanes continue to fade

- FHA loans remain the primary driver of stress in the market. While FHA delinquencies ticked down by 5 bps in July, they are still 15 bps above a year ago and now account for the majority (52%) of serious delinquencies nationwide

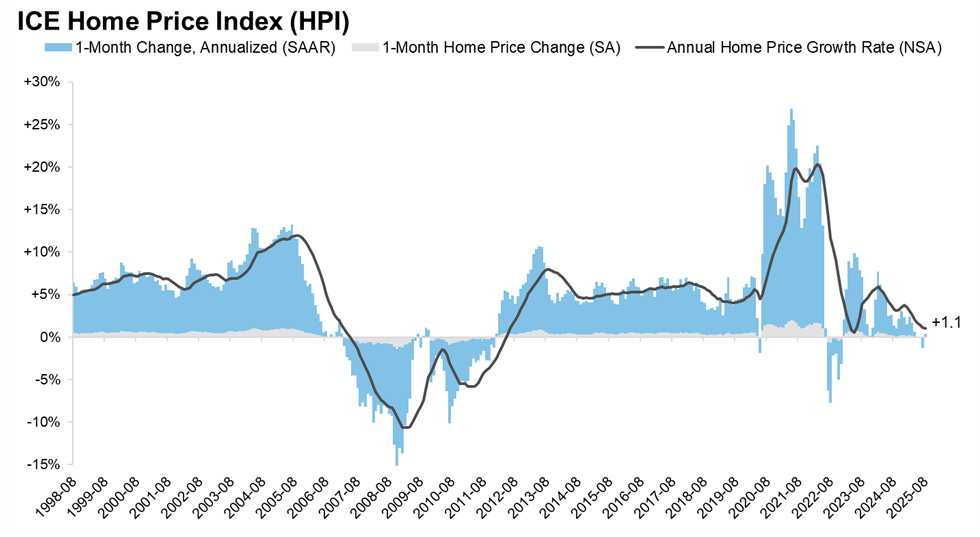

House Prices Up Slightly Year-over-year

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 1.1% year-over-year in August, unchanged from 1.1% YoY in July.

- The ICE Home Price Index shows prices firming slightly in August, with the annual home price growth rate holding at +1.1% in July, pausing after a streak of seven monthly declines

- Prices rose by +0.03% in the month, and while still cool, that marks the first single month growth since April, representing a seasonally adjusted annualized rate (SAAR) of +0.4%

- 85% of markets saw firmer prices in August than they did in July, with the uptick driven by a combination of slightly lower mortgage rates and improved affordability alongside a modest pullback in for-sale inventory

- Annual growth among single-family residences held steady at +1.4% YoY, while condo prices are now down -1.9%, marking further deterioration from -1.7% in July

There is much more in the mortgage monitor.