CALCULATEDRISK

By Bill McBride

Every housing cycle is different. One of the key themes in this cycle is that existing home inventory is historically extremely low as many homeowners are “locked in” to their current home with low mortgage rates.

Another key theme is that there will be few distressed sales as most homeowners have substantial equity.

Here is some data on outstanding mortgage rates and current loan-to-values.

Current Outstanding Mortgage Rates are Low

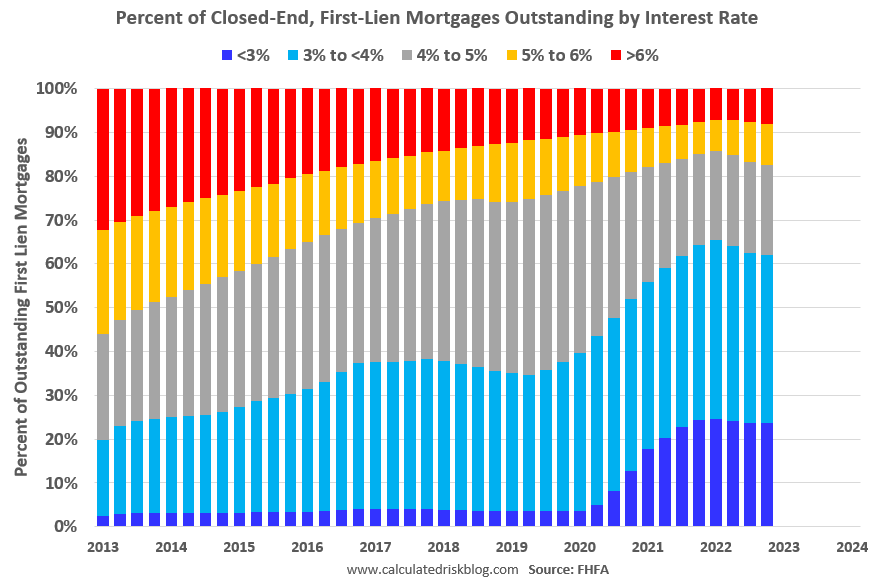

Here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2022.

This shows the recent surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.4%, and the percent under 5% peaked at 85.8%. These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are very low.

The percent of loans over 6% bottomed in Q2 2022 at 7.1% and has increased slightly to 8.2%.

There will be Few Distressed Sales

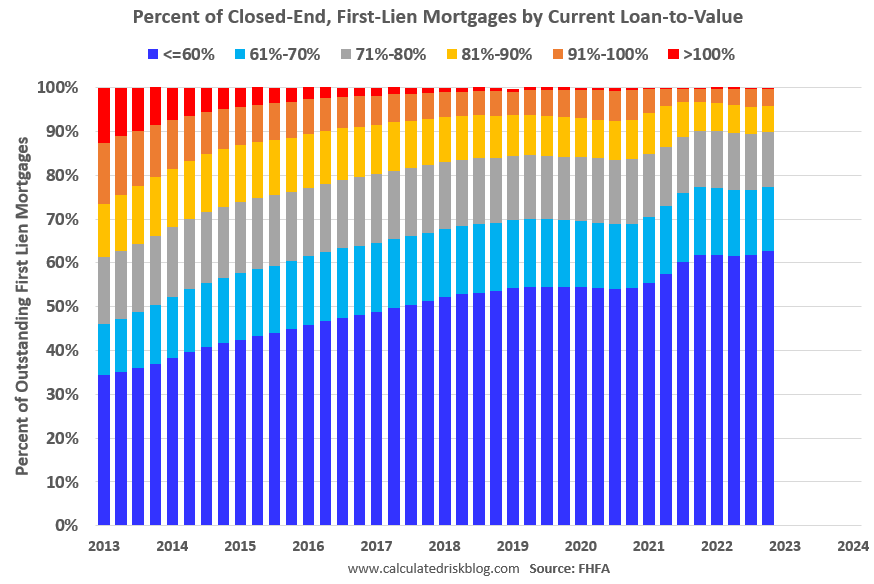

The second graph shows the current loan-to-value (LTV) of outstanding mortgage loans.

Most homeowners have substantial equity (Note: this doesn’t include homes without mortgages). Currently 62.7% of homeowners have loans with less than 60% LTV, and only 10.1% of a LTV above 80%.

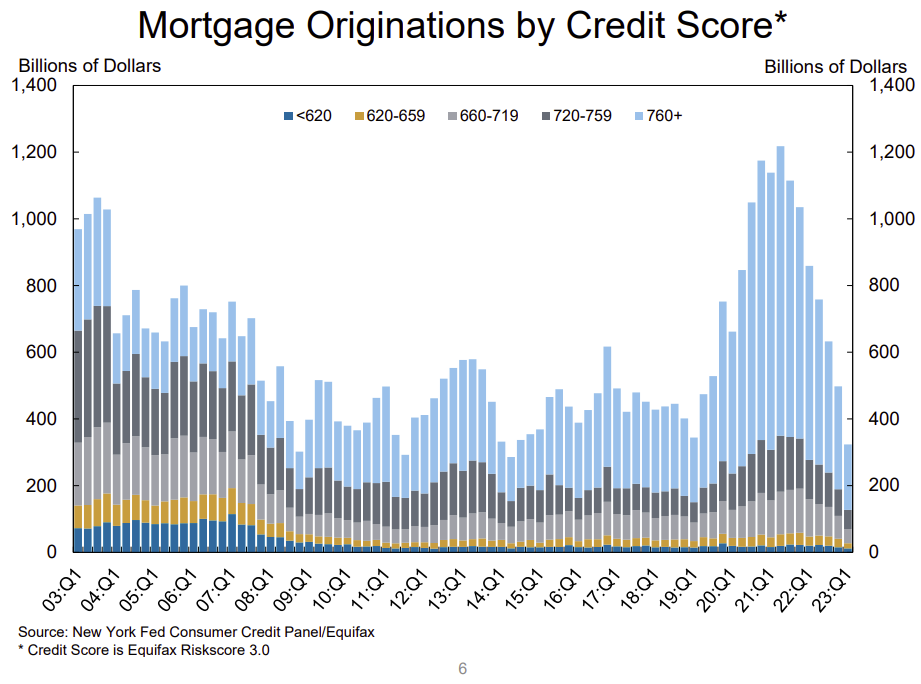

The third graph shows credit scores through Q1 2023 from the NY Fed Quarterly Report on Household Debt and Credit

During the housing bubble, there were a large number of loans to individuals with low credit scores and many had little or no equity and were underwater as house prices declined. In the 2020 to 2022 period, most borrowers – whether purchase or refinance -had excellent credit scores – and substantial equity. So, there will be few distressed sales this cycle.

Low existing home inventory levels and few distressed sales has been good news for homebuilders.