CALCULATEDRISK

By Bill McBride

House Prices:

It appears house prices – as measured by the national repeat sales index (Case-Shiller, FHFA, and Freddie Mac) – will be up mid-single digits in 2023. What will happen with house prices in 2024?

The first question I’m always asked about housing is “What will happen with house prices?” No one has a crystal ball, and it depends on supply and demand.

Looking back one year ago, there was a surge of inventory in 2022, and that led to some price declines. However, that surge in 2022 was somewhat of a head fake! Some potential sellers quickly listed their homes, probably remembering what happened with house prices in the 2006 to 2011 period, but that surge ended pretty quickly. We saw some price decline in late 2022 with very low inventory and fairly low month-of-supply, but as the surge ended, I changed my mind on house prices in 2023.

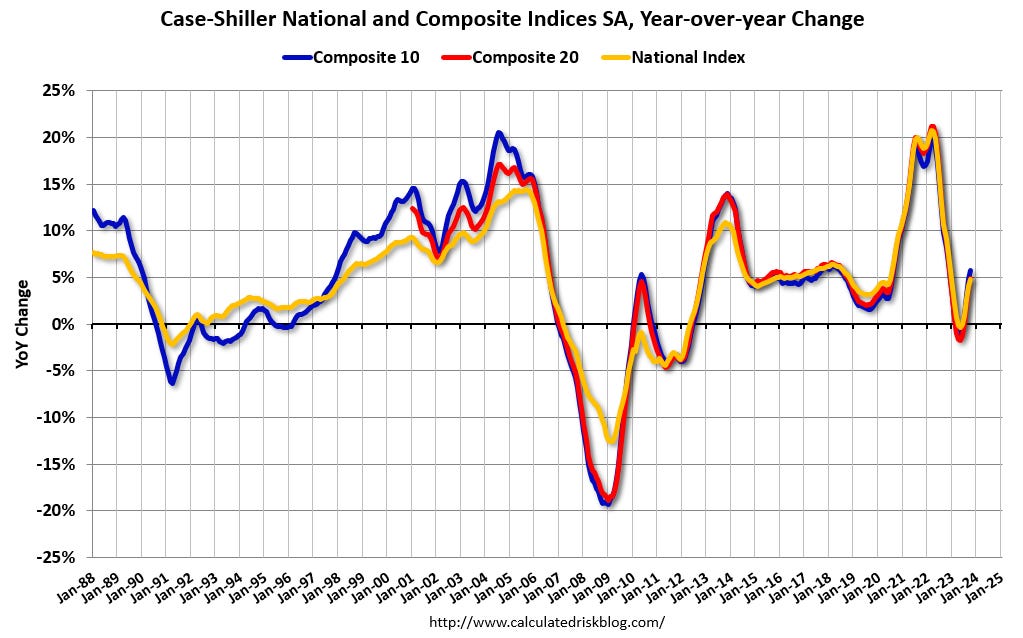

The following graph shows the year-over-year change through October 2023, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000). The Case-Shiller Home Price Indices for “October” is a 3-month average of August, September and October closing prices. August closing prices include some contracts signed in June, so there is a significant lag to this data.

The Composite 10 SA was up 5.7% year-over-year. The Composite 20 SA was up 4.9% year-over-year. The National index SA was up 4.8% year-over-year. All were at new all-time highs in October.

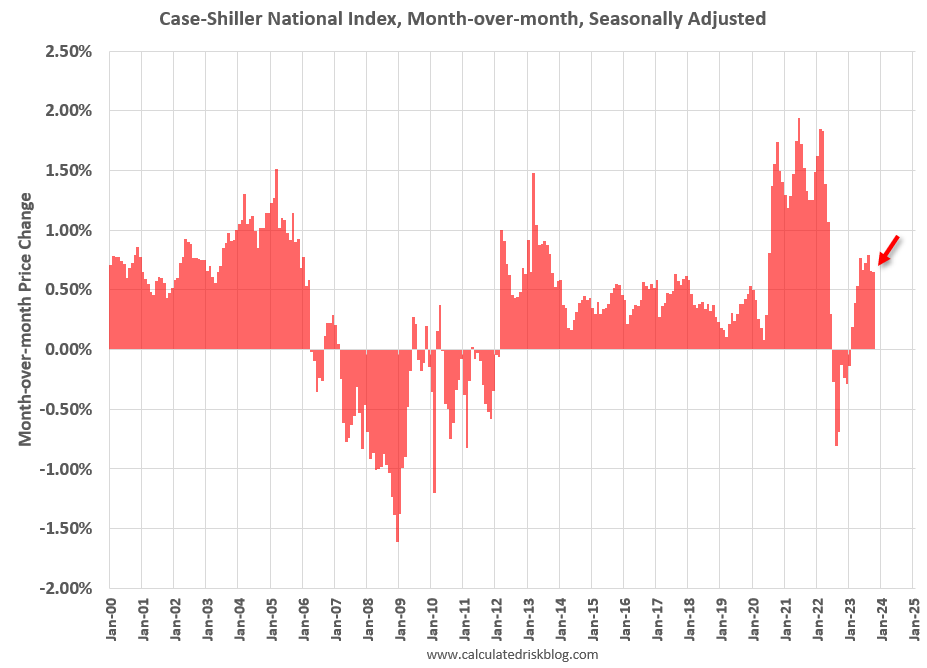

Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted Case-Shiller National Index was at 0.65%. This was the ninth consecutive MoM increase following seven straight MoM decreases at the end of 2022.

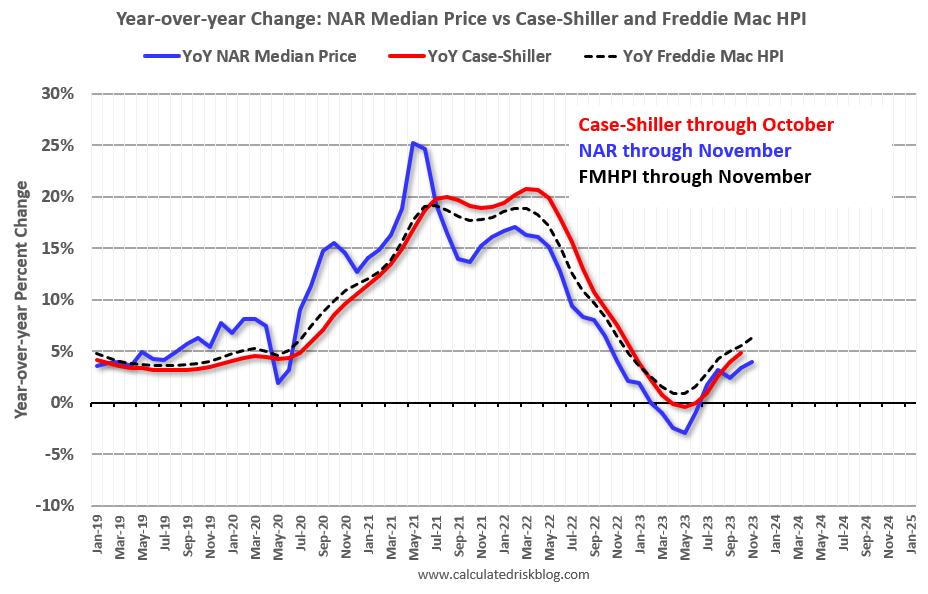

The following graph – as of the November NAR release and November Freddie Mac HPI – shows that Case-Shiller tends to follow median prices and the Freddie Mac index. And this suggests some further increase in the Case-Shiller YoY change.

Note: Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

Supply and Demand will be the Keys

Currently I expect inventory to increase further in 2024, and we will probably see some pickup in demand (even with 30-year fixed rate mortgages above 6%). There will still be significant affordability issues in 2024, even if 30-year mortgage rates drop into the high 5s, and that will limit demand this year.

On the supply side, most homeowners have substantial equity, and a low fixed-rate mortgage, and they can afford the monthly payments. So, it is extremely unlikely that we see a surge in distressed sales like happened after the housing bubble. That is why I’ve argued this cycle will be more like the 1978 to 1982 period than the housing bubble and bust.

The NAR reported that months-of-supply was at 3.5 months in November, and historically prices haven’t declined until inventory reached 6 months of supply.

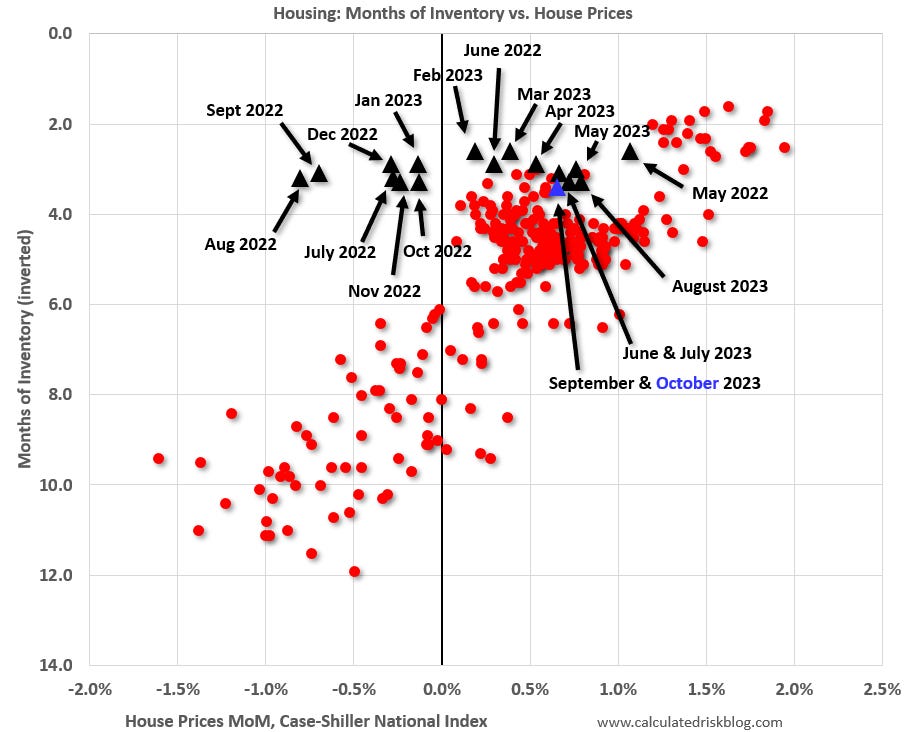

This graph below shows existing home months-of-supply, inverted, from the National Association of Realtors® (NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through October 2023). Note that the months-of-supply is not seasonally adjusted.

The recent months are in black (Oct 2023 in Blue) showing the impact of the initial surge in inventory in 2022 and prices fell for seven months with low levels of inventory!

The last several months are following the historic pattern.

In October, the months-of-supply was at 3.6 months, and the Case-Shiller National Index (SA) increased 0.65% month-over-month.

I don’t expect inventory to reach 2019 levels but based on the recent increase in inventory maybe more than half the gap between 2019 and 2023 levels will close in 2024. If existing home sales remain sluggish, we could see months-of-supply back to 2017 – 2019 levels.

That would likely put price increases in the 3% to 4% range in 2024. I don’t expect either a crash in prices or a surge in prices. And as usual, we will have to watch inventory and adjust the outlook. Right now, my guess is we see price increases in the low-to-mid single digits in 2024 as measured by the repeat sales indexes.