Inman News

Economists at Fannie Mae and the Mortgage Bankers Association differ on how much room mortgage rates have to come down and how fast home price appreciation will cool

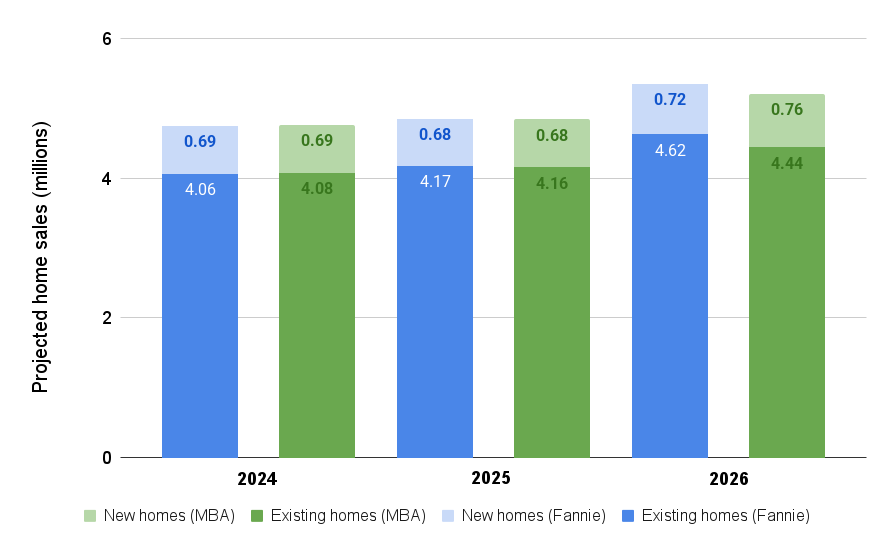

Forecasters at two mortgage industry giants expect home sales to rebound next year as price appreciation continues to decelerate and mortgage rates come down.

But the closely watched forecasts from Fannie Mae and the Mortgage Bankers Association differ markedly in their projections of how fast home price appreciation might cool and how much room mortgage rates have to come down.

In a forecast released Thursday, Fannie Mae’s Economic and Strategic Research (ESR) Group projected home sales will surge by 10 percent next year, to 5.35 million, as mortgage rates fall to 6 percent by Q4.

The Mortgage Bankers Association’s latest forecast, published on July 17, projects a more modest 7 percent rebound in 2026 sales, to 5.2 million.

Home sales forecasts diverge

Source: Fannie Mae and Mortgage Bankers Association forecasts, July 2025.

While Fannie Mae is forecasting sales of existing homes will grow by 451,000 next year, to 4.62 million, the MBA forecasts existing home sales will only grow by 285,000, to 4.44 million.

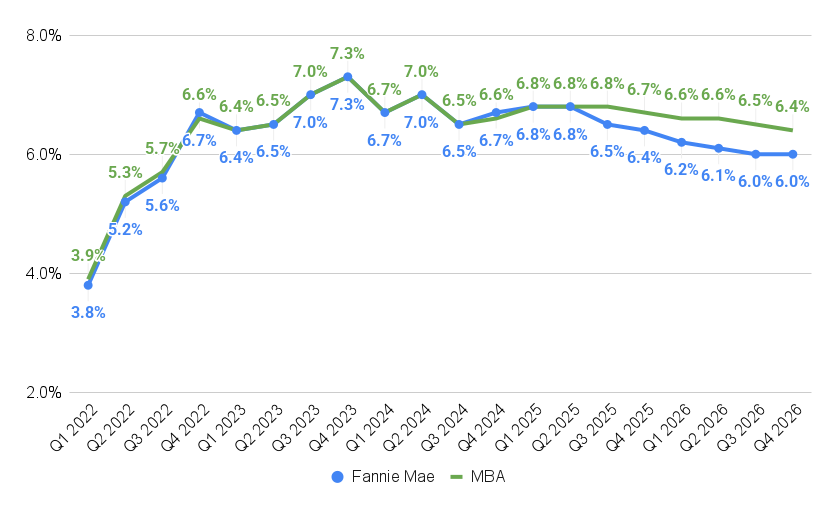

That’s due in part to Fannie Mae’s more optimistic outlook for mortgage rates to come down.

How fast will mortgage rates fall?

Source: Fannie Mae and Mortgage Bankers Association forecasts, July 2025.

Fannie Mae’s ESR Group thinks rates on 30-year fixed-rate mortgages could drop to 6.4 percent by the end of the year, and average 6 percent during the second half of 2026.

The MBA’s more cautious forecast is that mortgage rates will remain in the high sixes this year, falling only gradually to 6.4 percent by Q4 2026.

Which mortgage rate forecast proves to be more accurate could have significant real-world impacts.

“Home sales, homebuilding, and even house prices are set to slump unless mortgage rates decline materially from their current near 7 percent soon,” Moody’s Chief Economist Mark Zandi warned last week. “That, however, seems unlikely.”

With the Trump administration and the Federal Reserve locked in a battle of wills, it’s not easy to predict where mortgage rates will be a few months from now — let alone next year.

Federal Reserve policymakers have resisted the Trump administration’s calls to cut short-term interest rates, saying they need time to assess whether policies in areas including tariffs, immigration, taxes and regulation will rekindle inflation.

The CME FedWatch Tool, which tracks futures markets to predict future Fed moves, shows investors on Thursday think there’s only a 3 percent chance the central bank will cut rates at its July 30 meeting, but a 62 percent chance of a Sept. 17 rate cut.

A Fed rate cut wouldn’t necessarily mean lower mortgage rates, since rates on long-term investments like U.S. Treasurys and mortgage-backed securities are based on investor demand.

The last time the Fed cut the short-term federal funds rate — by a full percentage point over three months at the end of last year — mortgage rates increased by an equal amount as incoming economic data suggested inflation was on the rise again.

The latest reading of the consumer price index (CPI) showed annual inflation moved away from the Federal Reserve’s 2 percent goal in June for the second month in a row as tariffs on imports began to be passed on to consumers.

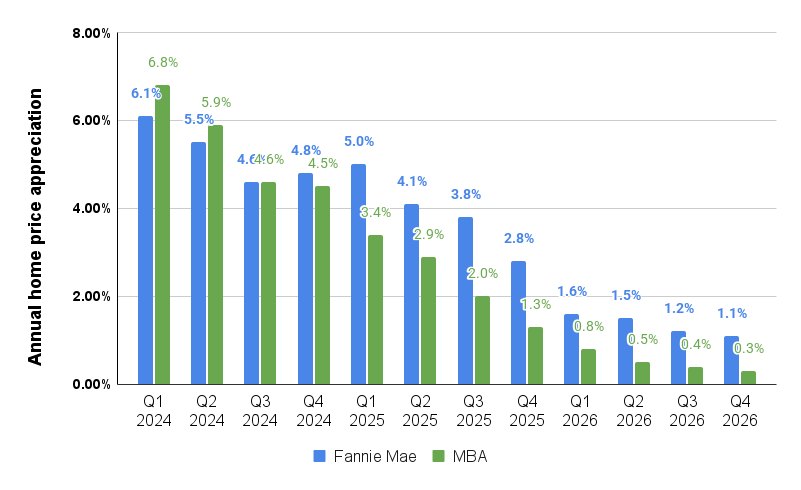

Another factor weighing on home sales has been affordability, with double-digit home price appreciation during the pandemic pricing many would-be homebuyers out of the market.

Economists at Fannie Mae and Freddie Mac expect home price appreciation to continue to cool this year and next, but differ on how drastically.

Home price appreciation cooling

Source: Fannie Mae and Mortgage Bankers Association forecasts, July 2025.

The MBA’s July 17 forecast envisions home price appreciation slipping to 1.3 percent by the end of this year, and pretty much running out of steam by the end of 2026, hitting 0.3 percent in Q4.

Fannie Mae economists think the run-up in home prices will cool more gradually, to 2.8 percent by the end of this year and 1.1 percent in Q4 2025.

Those projections are based on the Fannie Mae Home Price Index, a national, repeat-transaction home price that measured Q2 annual home price appreciation at 4.1 percent.

The MBA looks at the FHFA purchase-only House Price Index, which showed home price appreciation cooled to 3 percent in April.

Redfin’s June Home Price Index put annual home price growth at 3.4 percent, the lowest level seen since 2023.

As national home price appreciation cools, many markets are already seeing price declines.

The ICE Home Price Index measured annual home price growth slowing to 1.3 percent in early June — and found home prices were down by at least a full percentage point from their peaks in 31 the 100 largest U.S. housing markets.

Markets experiencing the biggest declines included Austin, Texas (-19.7 percent), Cape Coral, Florida (-13.3 percent), San Francisco (-8.9 percent), Phoenix (-5.7 percent), Boise City, Idaho (-5.2 percent), Denver, Colorado (-3.6 percent) and Dallas, Texas (-3.2 percent), ICE Mortgage Technology reported this month.