CALCULATEDRISK

By Bill McBride

Housing Inventory:

Housing inventory decreased sharply during the pandemic to record lows in early 2022. Since then, inventory has increased, but is still well below pre-pandemic levels. Will inventory increase further in 2024?

First, a brief history. Here are a few times when watching existing home inventory helped my analysis.

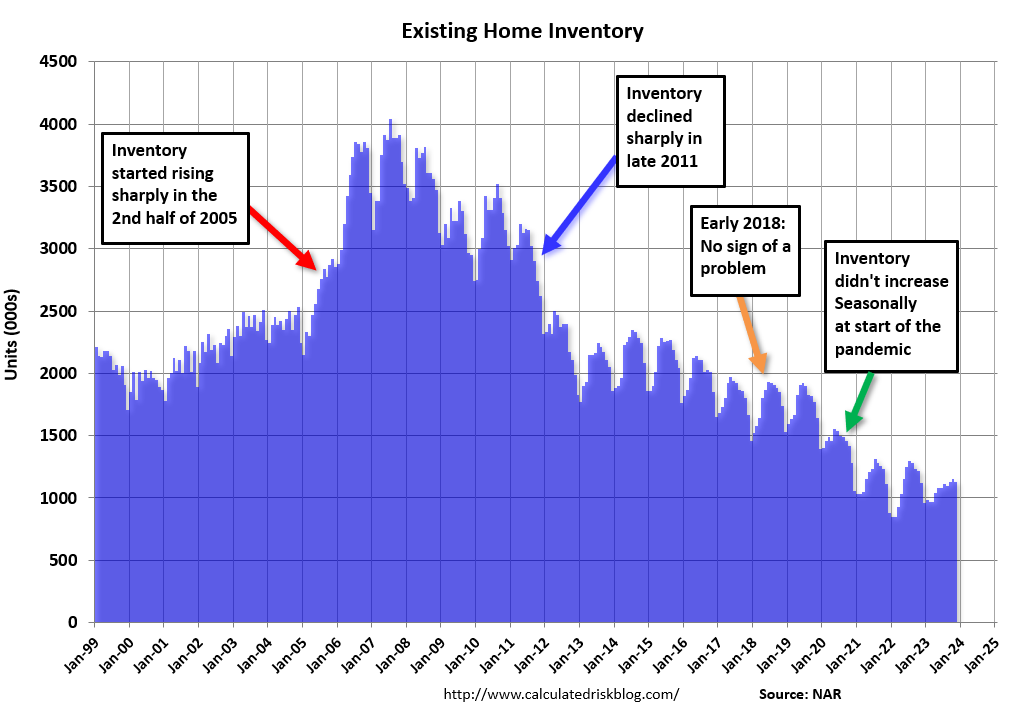

Starting in January 2005, I was very bearish on housing, but I wasn’t sure when the market would turn. Speculative bubbles can go on and on. However, the increase in existing home inventory in late 2005 (see red arrow on graph below) helped me call the top for house prices in 2006.

Several years later, in early 2012, when many people were still bearish on housing, the plunge in inventory in 2011 (blue arrow on graph below) helped me call the bottom for house prices in early 2012.

Six years ago, in January 2018, I was quoted in a Bloomberg article that included a bearish outlook for housing. I disagreed, and the steady level of inventory helped (see orange arrow above):

Bill McBride, who runs the Calculated Risk blog and also called the crash, doesn’t think home prices are inflated this time around. Unlike in 2005, lenders are acting responsibly and the Wild West of real estate speculation hasn’t returned, he said. There is less to speculate on, too. Compared with the overbuilding that preceded the bust, today’s pace of construction isn’t fast enough, he said.

And in December 2018, I disagreed with Professor Shiller. My conclusion:

No big deal, and definitely not a “gigantic” boom in house prices.

In 2019, when several commentators were bearish on housing, I pointed out there was no sharp increase in housing inventory (like in 2005), and that was one of the reasons I remained optimistic on housing and the economy (correctly!).

And the sharp decline in inventory during the pandemic (green arrow) was an indicator that price appreciation would increase. Inventory declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, initially a move away from multi-family rentals and strong second home buying (to escape the high-density cities). And at the same time, demographics were favorable for home buying (a large cohort had moved into the peak home buying years).

For 2023, inventory – according to the National Association of Realtors® (NAR) – didn’t increase significantly. The NAR reported inventory was up 0.9% year-over-year in November compared to November 2022.

Alternative measures of inventory

Mostly I focus on inventory as reported by the NAR. However, I also look at inventory from local markets and this showed inventory was down a little year-over-year in November).

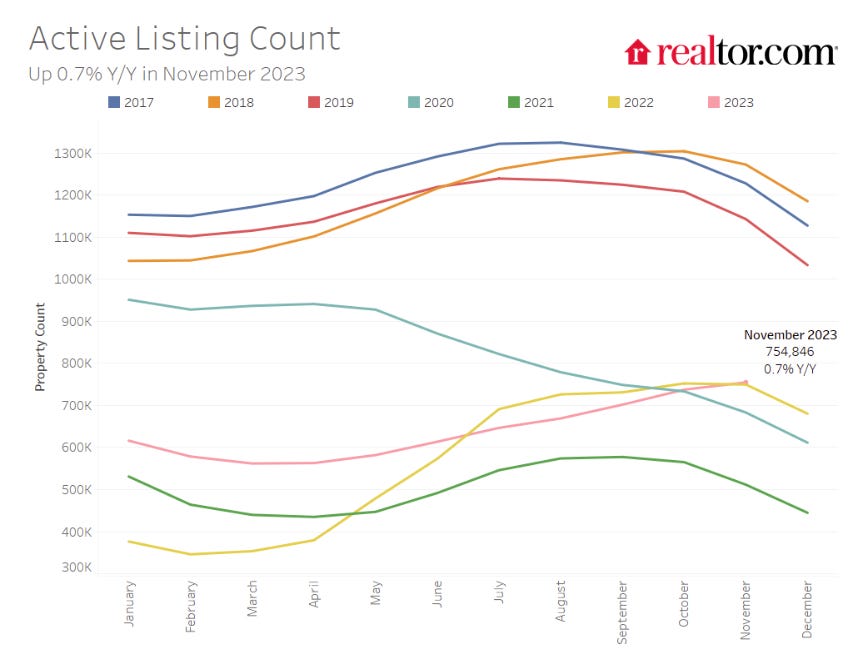

Here is a graph from Realtor.com showing active inventory through November 2023. Active inventory finished the year up slightly from November 2022, but still not close to the 2017 – 2019 levels.

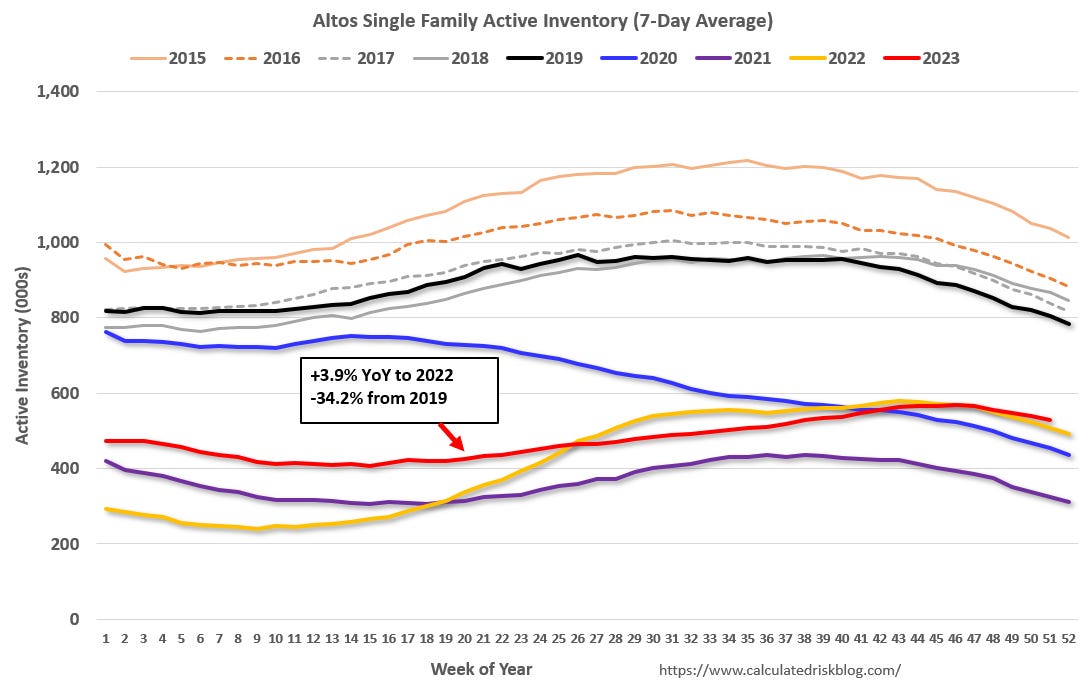

Another source is Altos Research that tracks active inventory weekly. This data is courtesy of Altos Research.

As of December 25th, Altos reports inventory was up 3.9% year-over-year, but still down 34.2% from the same week in 2019.

New Listings Might be Recovering

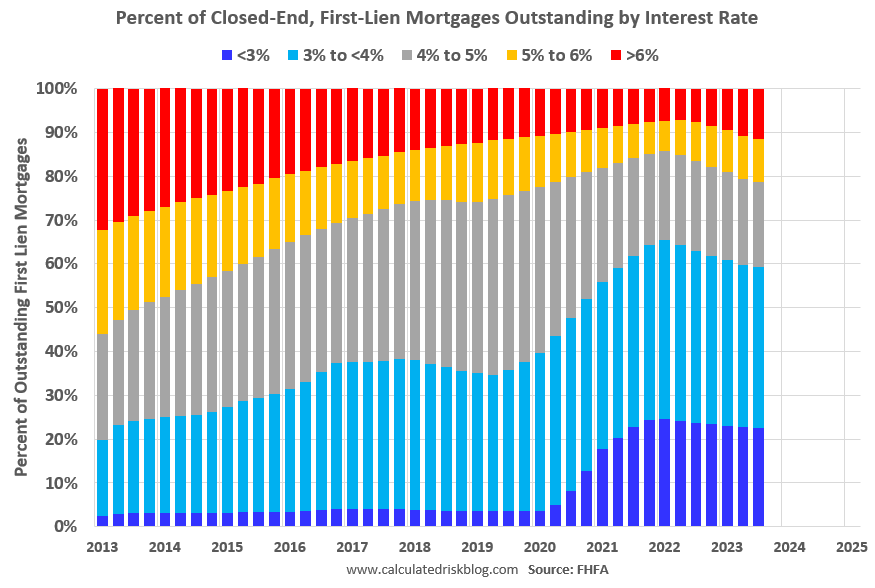

A key point for 2023 was that many potential sellers were locked into their current homes with low mortgage rates – and new listings were down sharply. This graph from the FHFA’s National Mortgage Database through Q3 2023 shows that the percent of outstanding loans under 4% is at 59.4%), and the percent under 5% peaked is at 78.7%.

Although many of these borrowers have “golden handcuffs”, the percent is declining over time as the need to move outweighs the extra cost. Still, these low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply.

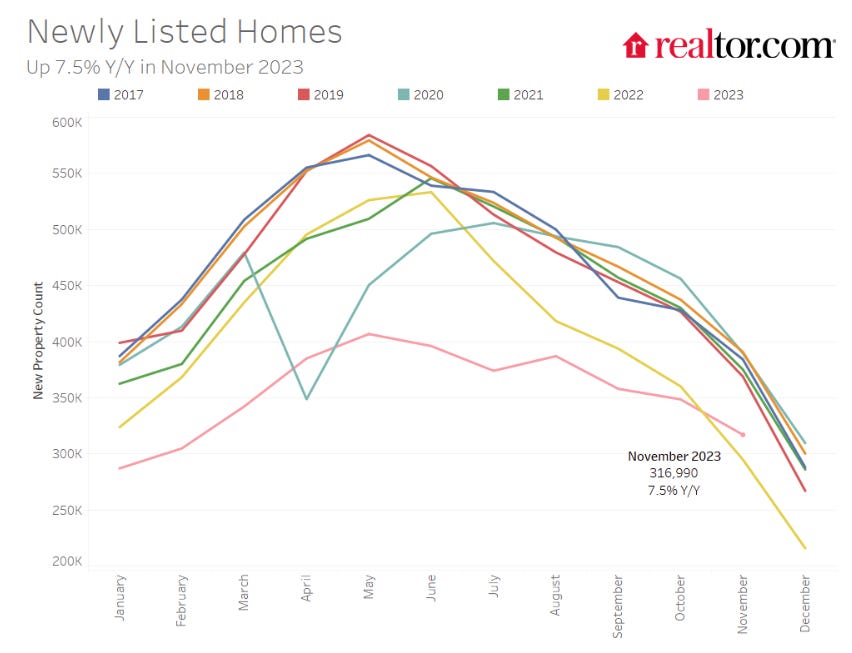

The local market reports show that new listings were up 4.8% year-over-year in November, Realtor.com reports new listings were up 7.5% YoY.

This is the slow season for new listings, and a key will be if new listings pickup in the Spring!

Conclusion

First, although the NAR has the most history, I’ll also be using active inventory from Realtor.com, Altos Research and a number of local markets to track inventory changes in 2024.

Somewhat lower mortgage rates – and time – will likely lead to more new listings in 2024. Still, mortgage rates will remain well above the pandemic lows, and therefore new listings will be depressed again in 2024.

The bottom line is inventory will probably increase year-over-year in 2024. However, it seems unlikely that inventory will be back up to the 2019 levels. Inventory is always something to watch!