Calculated Risk

Expect YoY Rents to Slow Further

By Bill McBride

The rental market has changed significantly from 2021 and the first half of 2022.

First, a few brief excerpts from an article by Will Parker at the WSJ: Apartment Rents Fall as Crush of New Supply Hits Market

Apartment rents fell in every major metropolitan area in the U.S. over the past six months through January, a trend that is poised to continue as the biggest delivery of new apartments in nearly four decades is slated for this year. …

While some seasonal stalling in rents is normal, the market faces a significant headwind in the biggest delivery of new supply since 1986, according to projections from CoStar Group. Nearly half a million new apartments are coming on line this year as developers seek to cash in on the high rents that tenants have been paying.

Less demand and more supply equals falling rents!

Year-over-year Rent Growth Continues to Decelerate

From ApartmentList.com: Apartment List National Rent Report

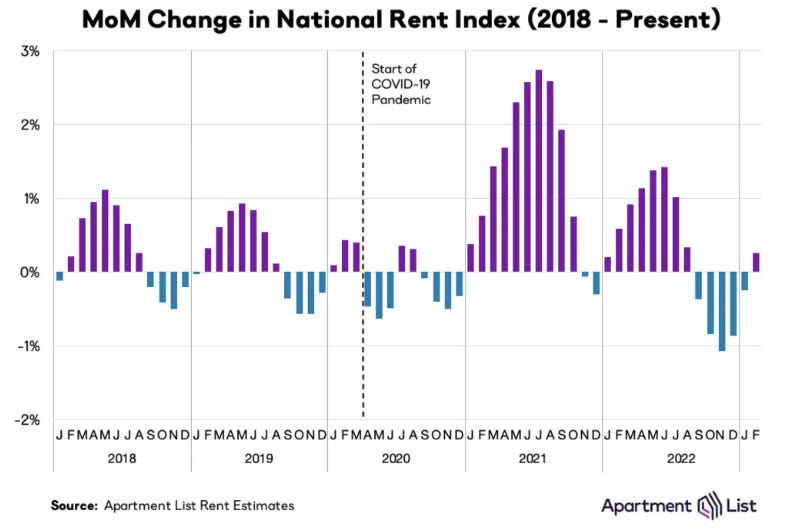

Welcome to the March 2023 Apartment List National Rent Report. Our national rent index increased by 0.3 percent over the course of February, marking a return to positive rent growth after five straight month-over-month declines. This month’s increase is of a similar magnitude to the typical February price change that we saw in pre-pandemic years. After a few months of record-setting price declines, it appears that rental demand is rebounding in line with the usual seasonal trend.

Year-over-year rent growth is continuing to decelerate, and now stands at 3.0 percent, its lowest level since April 2021. Year-over-year growth is now pacing just slightly ahead of the average rate from 2018 to 2019 (2.8 percent), and is likely to decline further in the months ahead.

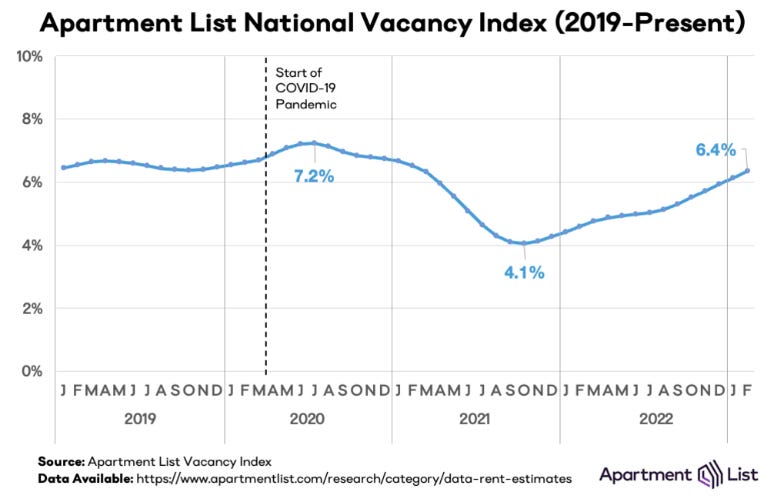

Even as rent growth has turned positive again, we continue to see easing on the supply side of the market. Our vacancy index now stands at 6.4 percent, its highest reading in two years. With a record number of multi-family apartment units currently under construction, we expect that supply constraints will continue to soften. 2023 could be the first time since the early stages of the pandemic that we see property owners competing for renters, rather than the other way around.

emphasis added

In 2022, rents increased 0.6% from January to February, and this year rents increased 0.3% (about half, but close to normal increase).

From Realtor.com: January 2023 Rental Report: Least Expensive Metros See Faster Rent Growth

In January 2023, the U.S. rental market experienced single-digit growth for the sixth month in a row after twelve months of slowing from January’s peak 16.2% growth. Median rent across the top 50 metros was up just 2.9% year-over-year for 0-2 bedroom properties, the lowest growth rate in 22 months. The median asking rent was $1,726, down by $7 from last month and $80 from the peak but is still $295 (20.6%) higher than the same time in 2020 (pre-pandemic).

CoreLogic also tracks rents for single family homes: CoreLogic: US Annual Rent Price Growth Dropped by Nearly Half in December

Rent price gains declined in December for the eighth straight month on an annual basis, but the 6.4% national increase remained higher than pre-pandemic levels. Although major tech company layoffs are making headlines, a still relatively healthy U.S. job market is keeping rent prices elevated, with the national unemployment rate hovering near a decade low in December. The job market’s impact on rental price growth has been particularly evident in cities like Miami, which led the country for annual increases throughout most of 2022. Miami’s unemployment rate was 1.6% in December, the lowest of the 20 metros for which CoreLogic publishes rental cost data.

“U.S. single-family rental price growth closed out 2022 at about half of what it was one year ago,” said Molly Boesel, principal economist at CoreLogic. “However, while rent growth has been slowing, it still rose at more than double the pre-pandemic rate. Rental price gains began increasing near the end of 2020 and have risen by about an average of $300 in the past two years. Annual single-family rent growth is projected to slow throughout 2023, but it will likely not decline by enough to wipe out gains from the past two years.”

The 6.4% YoY increase in December was down from 7.5% in November.

Rent Data

I’m going to update some of the data on rents. Here is a graph of several measures of rent since 2000: OER, rent of primary residence, Zillow Observed Rent Index (ZORI), ApartmentList.com and CoreLogic Single Family Rental Index (All set to 100 in January 2017)

Note: For a discussion on how OER, and Rent of primary residence are measured, see from the BLS: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and rent of primary residence (Rent)

OER and rent of primary residence have mostly moved together. The Zillow index started in 2014, the ApartmentList index started in 2017, and CoreLogic in 2004.

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through January 2023, except CoreLogic is through December and Apartment List is through February 2023.

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

The CoreLogic measure is up 6.4% YoY in December, down from 7.5% in November, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 6.9% YoY in January, down from 7.5% YoY in December, and down from a peak of 17.0% YoY in February 2022.

The ApartmentList measure is up 3.0% YoY as of February, down from 3.3% in January, and down from a peak of 18.0% YoY November 2021.

Both the Zillow measure (a repeat rent index), and ApartmentList are showing a slowdown in rental increases in rents. From Zillow:

“ZORI is a repeat-rent index that is weighted to the rental housing stock to ensure representativeness across the entire market, not just those homes currently listed for-rent.”

And from ApartmentList:

At Apartment List, we estimate the median contract rent across new leases signed in a given market and month. To capture how rents change in a market over time, we estimate the expected price change that a rental unit should experience if it were to be leased today.

Both of these measures reflect new leases, whereas most rental units don’t turnover every year (as captured by the BLS measures). The sharp increase in new lease rates in 2021 and early 2022 is spilling over into the consumer price index now (as discussed in earlier article).

Rents are still increasing YoY, and we should expect this to continue to spill over into measures of inflation. The Owners’ Equivalent Rent (OER) was up 7.8% YoY in January, from 7.5% YoY in November – and might increase further in the coming months even as rents slow.

Conclusion

My suspicion is rent increases will slow further over the coming months with slow household formation, and more supply comes on the market. It is possible that we will see a year-over-year decline in rents sometime this year.